What Does Experienced Bankruptcy Lawyer Tulsa Do?

What Does Experienced Bankruptcy Lawyer Tulsa Do?

Blog Article

4 Easy Facts About Bankruptcy Lawyer Tulsa Described

Table of ContentsThe Only Guide to Top-rated Bankruptcy Attorney Tulsa OkChapter 7 - Bankruptcy Basics Can Be Fun For AnyoneSome Known Facts About Chapter 7 Vs Chapter 13 Bankruptcy.The 3-Minute Rule for Bankruptcy Attorney Near Me TulsaExamine This Report about Chapter 7 Vs Chapter 13 Bankruptcy

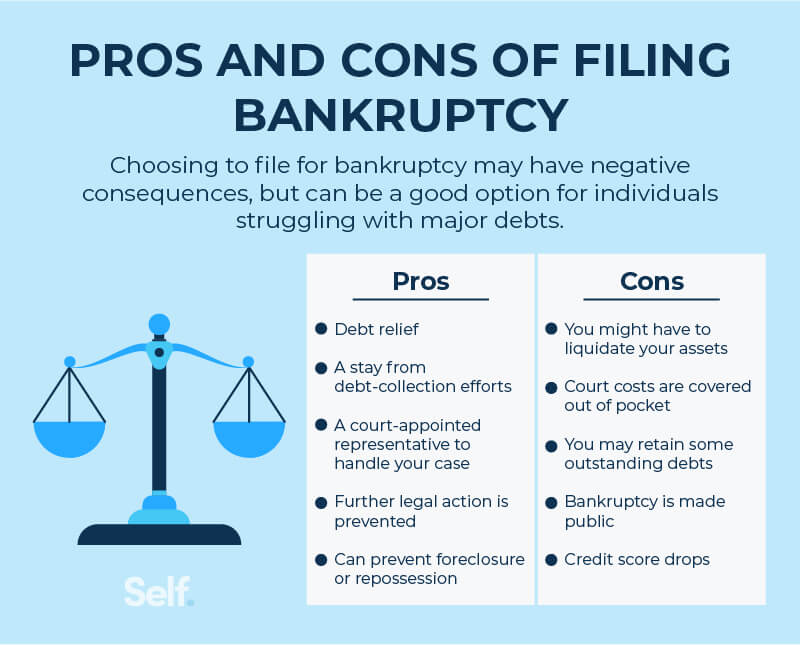

The statistics for the other primary kind, Chapter 13, are even worse for pro se filers. (We break down the distinctions in between the 2 enters deepness below.) Suffice it to state, consult with an attorney or more near you that's experienced with personal bankruptcy regulation. Here are a couple of resources to discover them: It's understandable that you could be reluctant to spend for an attorney when you're currently under substantial financial stress.Lots of attorneys also use cost-free consultations or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is certainly the right option for your scenario and whether they believe you'll qualify.

Ad Now that you have actually decided personal bankruptcy is certainly the right training course of activity and you ideally cleared it with an attorney you'll require to get begun on the paperwork. Prior to you dive right into all the main insolvency kinds, you need to obtain your very own files in order.

The Ultimate Guide To Chapter 13 Bankruptcy Lawyer Tulsa

Later on down the line, you'll actually require to prove that by revealing all type of information regarding your economic events. Here's a basic listing of what you'll require on the roadway in advance: Determining documents like your driver's certificate and Social Safety card Tax returns (approximately the past 4 years) Evidence of revenue (pay stubs, W-2s, independent profits, income from possessions in addition to any kind of revenue from government benefits) Financial institution declarations and/or pension statements Evidence of worth of your properties, such as car and realty assessment.

You'll wish to recognize what kind of financial debt you're attempting to resolve. Debts like child support, spousal support and certain tax obligation financial debts can't be released (and personal bankruptcy can not stop wage garnishment associated to those financial obligations). Pupil funding financial debt, on the various other hand, is possible to discharge, however note that it is challenging to do so (bankruptcy lawyer Tulsa).

You'll wish to recognize what kind of financial debt you're attempting to resolve. Debts like child support, spousal support and certain tax obligation financial debts can't be released (and personal bankruptcy can not stop wage garnishment associated to those financial obligations). Pupil funding financial debt, on the various other hand, is possible to discharge, however note that it is challenging to do so (bankruptcy lawyer Tulsa).If your revenue is expensive, you have an additional option: Chapter 13. This option takes longer to settle your debts because it requires a long-lasting settlement plan usually 3 to 5 years before several of your remaining financial debts are wiped away. The filing procedure is also a whole lot more intricate than Phase 7.

The Facts About Tulsa Ok Bankruptcy Specialist Revealed

A Phase 7 insolvency remains on your credit history report for ten years, whereas a Chapter 13 insolvency diminishes after 7. Both have long-term impacts on your credit report rating, and any kind of brand-new financial debt you get will likely include greater passion rates. Prior to you submit your bankruptcy forms, you should first complete a required program from a credit rating therapy company that has been accepted by the Division of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The training course can be finished online, face to face or over the phone. Training courses commonly set you back between $15 and $50. You should complete the program within 180 days of declare bankruptcy (bankruptcy lawyer Tulsa). Make use of the Division of Justice's site to discover a program. If you reside in Alabama or North Carolina, you should pick and complete a course from a checklist of independently accepted carriers in your state.

The Basic Principles Of Bankruptcy Lawyer Tulsa

An attorney will commonly manage this for you. If you're submitting on your very own, know that there have to do with 90 different insolvency districts. Check that you're filing with the correct one based upon where you live. If your irreversible residence has actually relocated within 180 days of filling, you need to submit in the district where you lived the greater portion of that 180-day period.

Normally, your bankruptcy lawyer will deal with the trustee, yet you might need to send out the person files such as pay stubs, income tax return, reference and checking account and bank card declarations straight. The trustee that was just selected to your case will soon establish up a mandatory meeting with you, called the "341 conference" because it's a demand of Section 341 of the united state

You will need to supply a timely checklist of what certifies as an exemption. Exceptions may put on non-luxury, main automobiles; essential home products; and home equity (though these exemptions regulations can vary widely by state). Any type of home outside the list of exemptions is considered nonexempt, and if you don't supply any listing, then all your residential or commercial property is considered nonexempt, i.e.

You will need to supply a timely checklist of what certifies as an exemption. Exceptions may put on non-luxury, main automobiles; essential home products; and home equity (though these exemptions regulations can vary widely by state). Any type of home outside the list of exemptions is considered nonexempt, and if you don't supply any listing, then all your residential or commercial property is considered nonexempt, i.e.The trustee wouldn't market your cars to promptly pay off the creditor. Instead, you would pay your lenders that amount throughout your layaway plan. An usual misunderstanding with personal bankruptcy is that once you file, you can quit paying your financial debts. While personal bankruptcy can assist you clean out a lot of your unsafe debts, such as past due medical bills or personal financings, you'll wish to maintain paying your month-to-month settlements for protected financial obligations if you wish to maintain the residential or commercial property.

Not known Factual Statements About Top Tulsa Bankruptcy Lawyers

If you're at threat of repossession and have actually tired all various other financial-relief alternatives, after that submitting for Chapter 13 may postpone the foreclosure and help conserve your home. Eventually, you will certainly still require the earnings to continue making future home mortgage settlements, along with repaying any late repayments over visit the website the program of your layaway plan.

If so, you may be required to supply extra info. The audit might postpone any type of debt alleviation by several weeks. Certainly, if the audit turns up inaccurate information, your instance could be dismissed. All that said, these are relatively uncommon circumstances. That you made it this far while doing so is a good sign at the very least a few of your debts are qualified for discharge.

Report this page